The Smart Blog

Home Equity Planning: Smart Moves Before the New Year

As the year comes to a close, many Dallas/Fort Worth homeowners are taking a closer look at their biggest investment: their home. The region’s steady growth has created new opportunities to build wealth, plan, and make informed financial decisions before the new year begins.

Whether you are thinking about selling, refinancing, or reinvesting in your home, a little year-end planning can help set the stage for a successful start to 2026.

Understanding Home Equity

Home equity is the difference between your home’s current market value and what you owe on your mortgage. In a strong and resilient market like DFW, many homeowners have built substantial equity over the past few years, often more than they realize.

Knowing how much equity you have can help you make wise decisions about your next steps, whether that is leveraging your home’s value or protecting it for the long term.

Five Smart End-of-Year Home Equity Moves

- Get a Current Market Evaluation

Your home’s value can change quickly in today’s market. A professional market analysis provides a clear overview of what your property is worth right now. Understanding your home’s equity position can help you make informed financial choices for the year ahead.

- Review Refinancing Opportunities

If mortgage rates or lending programs have shifted, this may be a good time to review your refinance options. A lower rate or shorter loan term can help reduce monthly payments or save money over time, giving you greater flexibility as you plan for 2026.

- Use Equity to Add Value

If you are considering home improvements, investing in strategic updates can further boost your property’s value. Focus on projects that provide strong returns, such as:

- Curb appeal updates like fresh paint and landscaping

- Kitchen or bathroom renovations

- Energy-efficient upgrades

- Review Tax Benefits

Before the year’s ends, consult your tax professional about potential deductions or advantages related to mortgage interest or property taxes. A few small adjustments before December 31st can make a significant difference during the tax season.

- Consider a Home Equity Line of Credit

For homeowners with strong equity, a home equity line of credit (HELOC) can provide flexible access to funds for renovations, investments, or unexpected expenses. Used wisely, it can be a valuable tool for managing your finances while preserving your long-term goals.

Planning for 2026

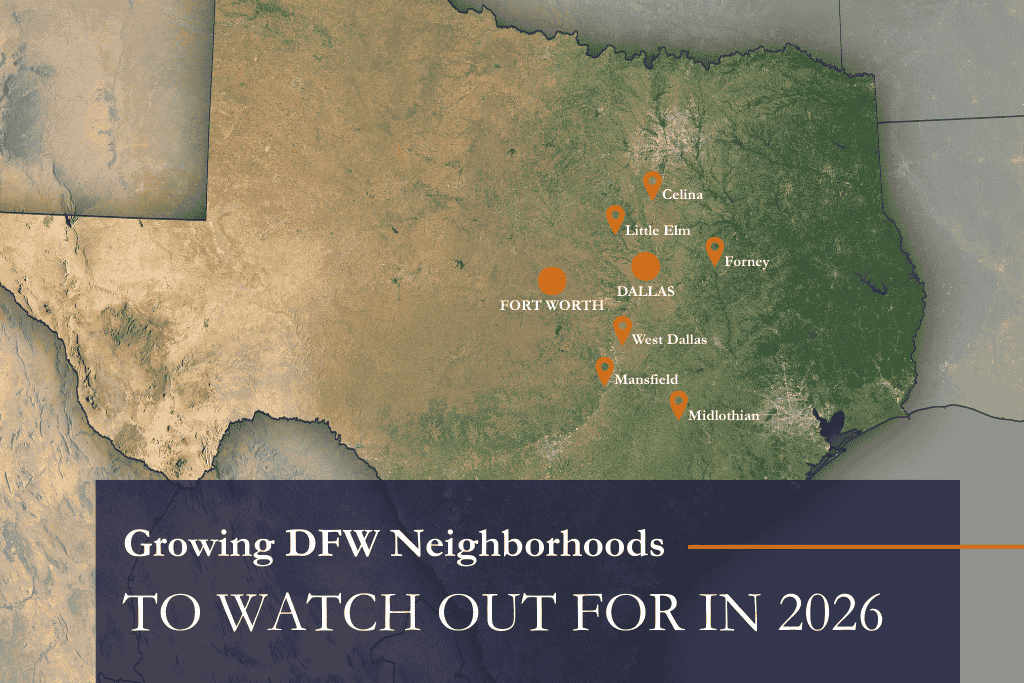

The Dallas–Fort Worth real estate market remains one of the most stable and sought-after regions in the country. From Frisco and Prosper to Arlington and Mansfield, steady growth continues to help homeowners build equity and strengthen their financial position.

Before the new year begins, take time to review your home’s current value and explore how your equity can help you achieve your goals. Be sure to explore our resources for more insight.

Our team is here to help you understand your home’s value and create a plan that aligns with your goals for the year ahead. Contact Smart Realty today to schedule your personalized market evaluation and discover what your home equity can do for you.

Stay Up-To-date On the Housing Market

The Smart Blog